Revenue is a function of both price and volume. In turbulent times, many companies react to the uncertainty by focusing on growing volumes as the key driver of revenue growth. This is typically achieved by lowering prices, especially in recessionary times when demand is more price elastic. However, during a recession, brands would be better advised to focus on strategies that increase volume without reducing prices. While this requires some creativity, it is the best way to sustain long-term revenue growth. Let’s take a look at some potential consequences of lowering how much you charge for your product or service:

-

Lowering prices shrinks profit margins, and not just in the short term. Adjusting how much you charge in the face of falling demand is a problematic strategy because once a brand goes down the path of reducing prices, it will have difficulty raising them to historical levels, especially if the market has adjusted. According to the Harvard Business Review, producer prices dropped by almost 8% during the last recession and it took nearly two years to recover [1].

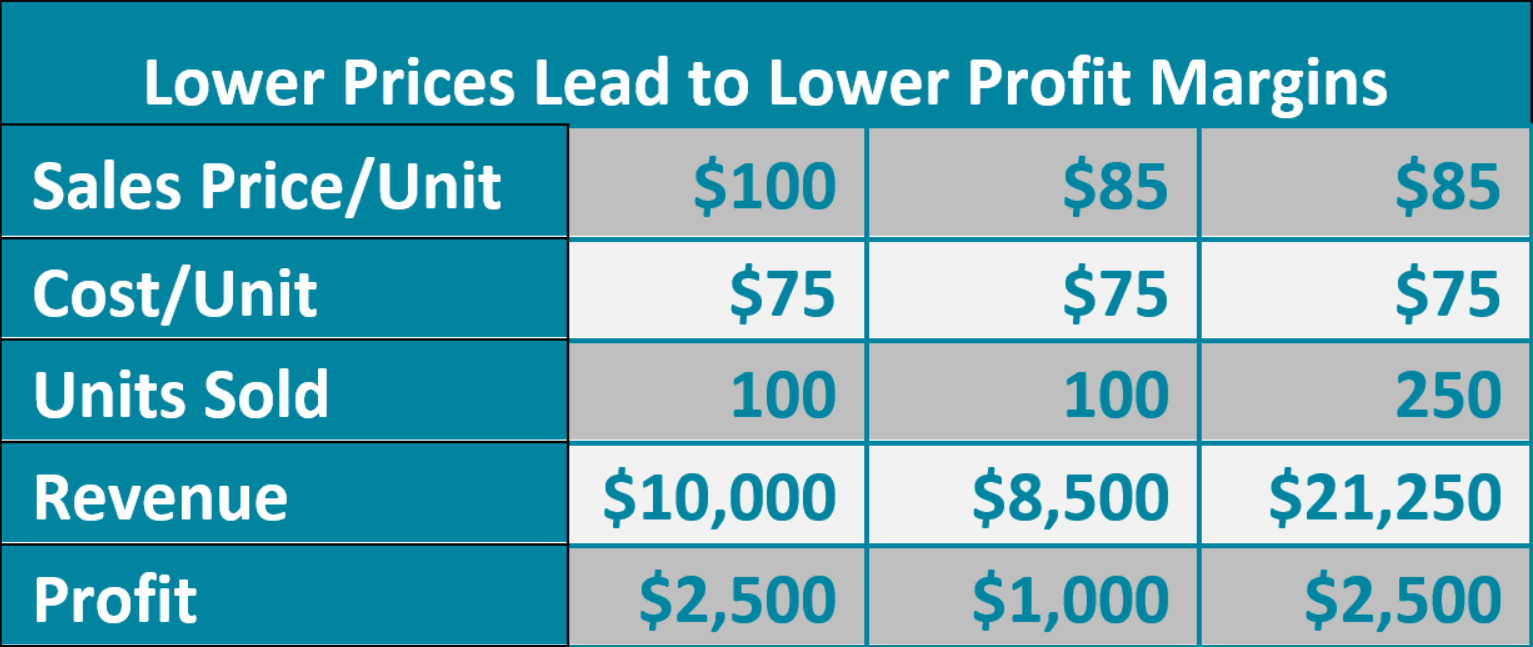

Lower prices will lead to lower profit margin if the increase in sales volumes does not cover the amount of price decrease. Let’s use an example to demonstrate:

Let’s assume you sell your product for $100. With 100 units sold, your profit is $2,500. If you reduce the price to $85 (15% reduction), your profit will fall 60% to $1,000, assuming the same 100 units are sold. This means that in order to generate the same level of profit ($2,500), you will need to sell an additional 150 units. In other words, you would need to increase your sales 150% to cover the 15% price reduction. And that is just to break even on margin.

-

Lowering prices can negatively impact your brand, especially if you are the market leader. Every company wants to fully optimize their price point so that it captures the full value of their brand. When a brand lowers its prices, consumers start to value it differently, and once the perception of a brand has been altered, it’s difficult to reverse consumer sentiment. Macy’s, once regarded as an upscale department store, surrendered to competitive pressures by lowering its prices so significantly that it is now widely perceived as a discount store. It’s unlikely the brand will ever recover the status it once enjoyed.

Market-leading brands would do well to remember that they do not need to follow the pricing of discount brands because their customers are willing to pay more for perceived value. For example, over the years, T-Mobile and Sprint have regularly priced their products below similar AT&T and Verizon products. As market leaders, AT&T and Verizon have not followed suit because their brands are recognized for reliability and quality service, and the customers whom they target are willing to pay more for these brands due to their solid reputations.

-

Lower prices won’t result in long-term volume increases if matched by the competition. Lower prices may result in short-lived increases in volume, but more than likely, the market will respond to the change in price. If competitors match the price decrease, overall industry volumes may increase, but typically, volumes fall back to historical levels and nobody benefits. At the end of the day, each brand’s volume will be unchanged, and the industry will be worse off due to lower prices and lower margins.

Recessions present a perfect opportunity for all brands to assess their pricing strategies to make sure they are consistent with the perceived value of their goods or services. Pricing excellence does not necessarily result in reductions, rather it leverages data to determine the ideal price point to maximize a brand’s revenue potential, even in times of slowing demand.

The Northridge Group is a leading pioneer in Pricing Excellence for businesses worldwide. Enable your business with the right components and take the first step in driving revenue to the bottom line.

Interested in taking your pricing strategy to the next level? Contact Us today to learn more about how partnering with The Northridge Group can help solve your business challenges.

- Shihwan Chung et al., “Why You Shouldn’t Slash Prices in the Next Recession,” Harvard Business Review, October 30, 2019,