Reading time: 1 Minute

Case Studies / Quality Monitoring

Compliance Monitoring Allows Leading Financial Services Firm to Achieve 16% Compliance Improvement within One Year

Financial Services

Scope

- Financial Services firms face increasing Federal regulatory requirements. Non-compliance creates significant financial risk, while compliance creates real operational challenges, especially for Customer Service organizations that interact directly with consumers.

- Northridge partnered with a leading Financial Services firm to identify potential compliance violations and risks, and provide an actionable plan for implementing improvements.

Approach

- Designed and implemented a compliance monitoring program specific to the regulations that created the greatest risk for our client.

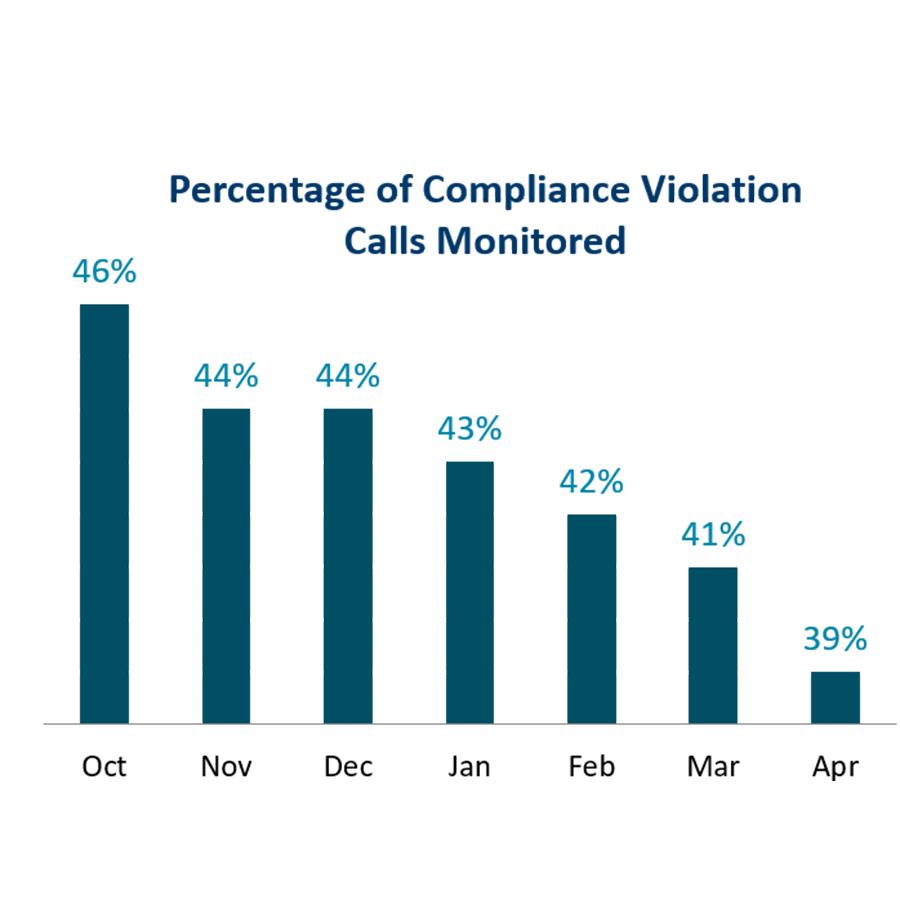

- Monitored a statistically valid sample size of calls on a monthly basis to determine which compliance violations occurred most often.

- Recommended actionable performance management and training remedies for frequently recurring compliance violations.

Results

- Compliance-based violations decreased by more than 16% overall in just 7 months.

- Reduction in compliance-based violations resulted in significantly mitigated risk and fewer fines.

Let’s Talk About Your Organization

With experience across nearly every industry, non-profit and governmental agency, we have the team to help you grow.